Launch credit line on UPI at industry-best speed.

CARD91's highly configurable CLMS platform enables issuers to design and customise credit schemes, supporting various product types including interest-free, interest-bearing, fixed-term loans, and revolving credit to cater to diverse target segments.

Our modular framework empowers issuers to effortlessly customise, expand, and integrate features, ensuring a solution that can evolve with your dynamic business requirements.

CARD91's CLMS platform is compliant with the regulator's guidelines pertaining to digital lending.

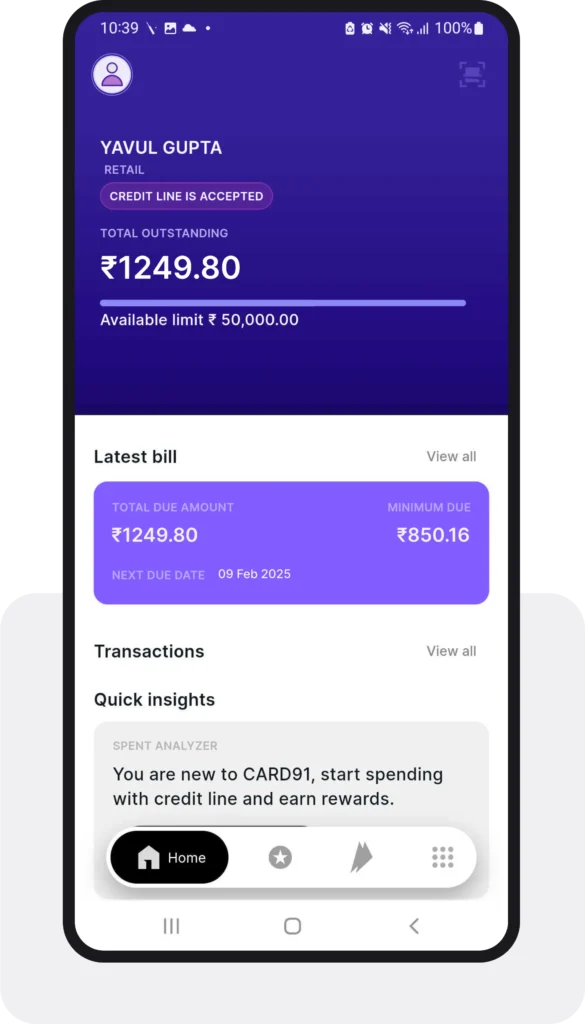

Allows seamless incorporation of CARD91's CLMS into your existing banking processes. This ensures easy management of credit lines through your issuer portal. Seamless integration of CARD91's SDKs with your mobile app/net banking.

Our UPI switch is certified with NPCI for UPI 2.0 which comes pre-integrated with CARD91's credit line management system or can be offered standalone.

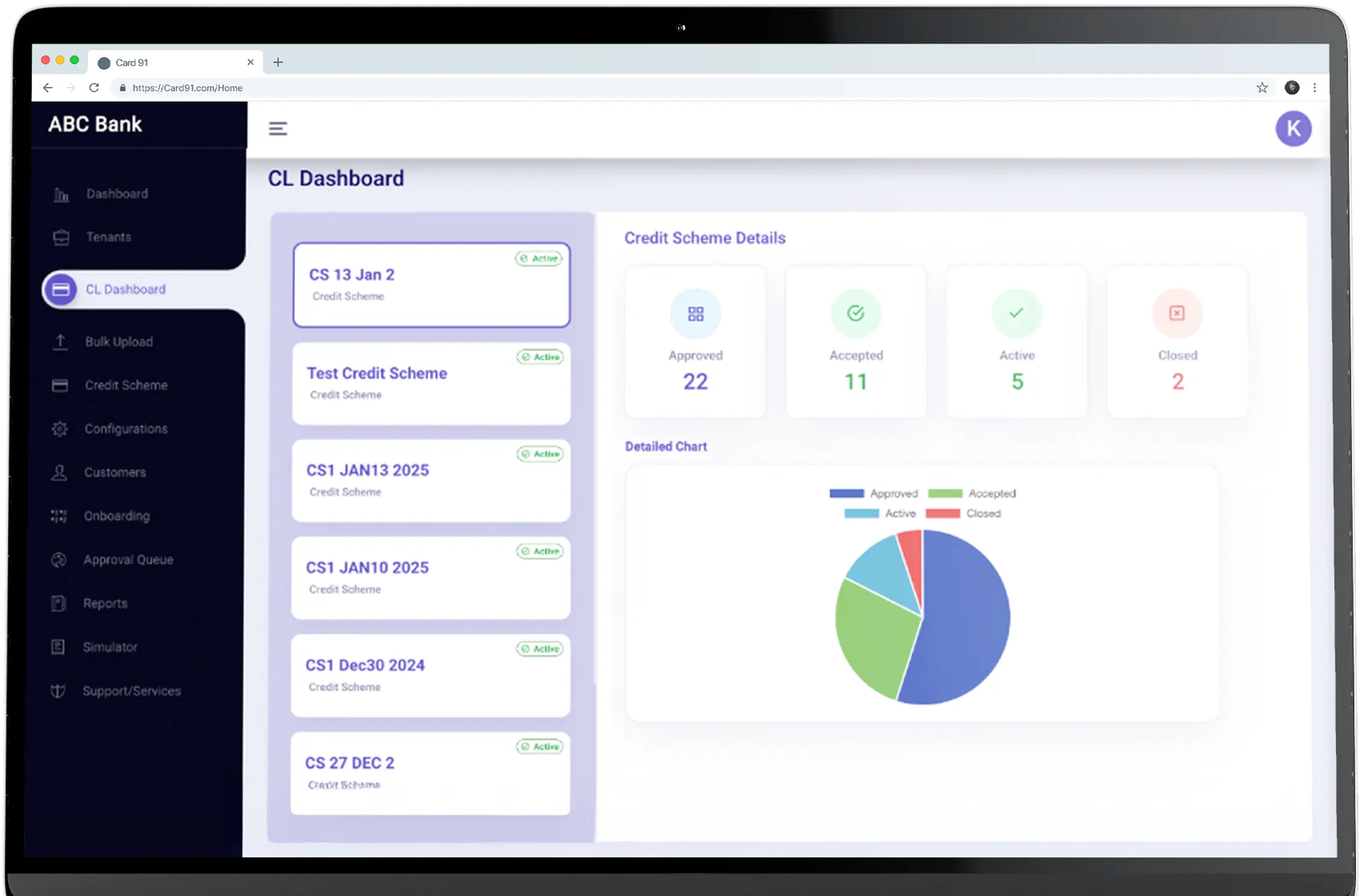

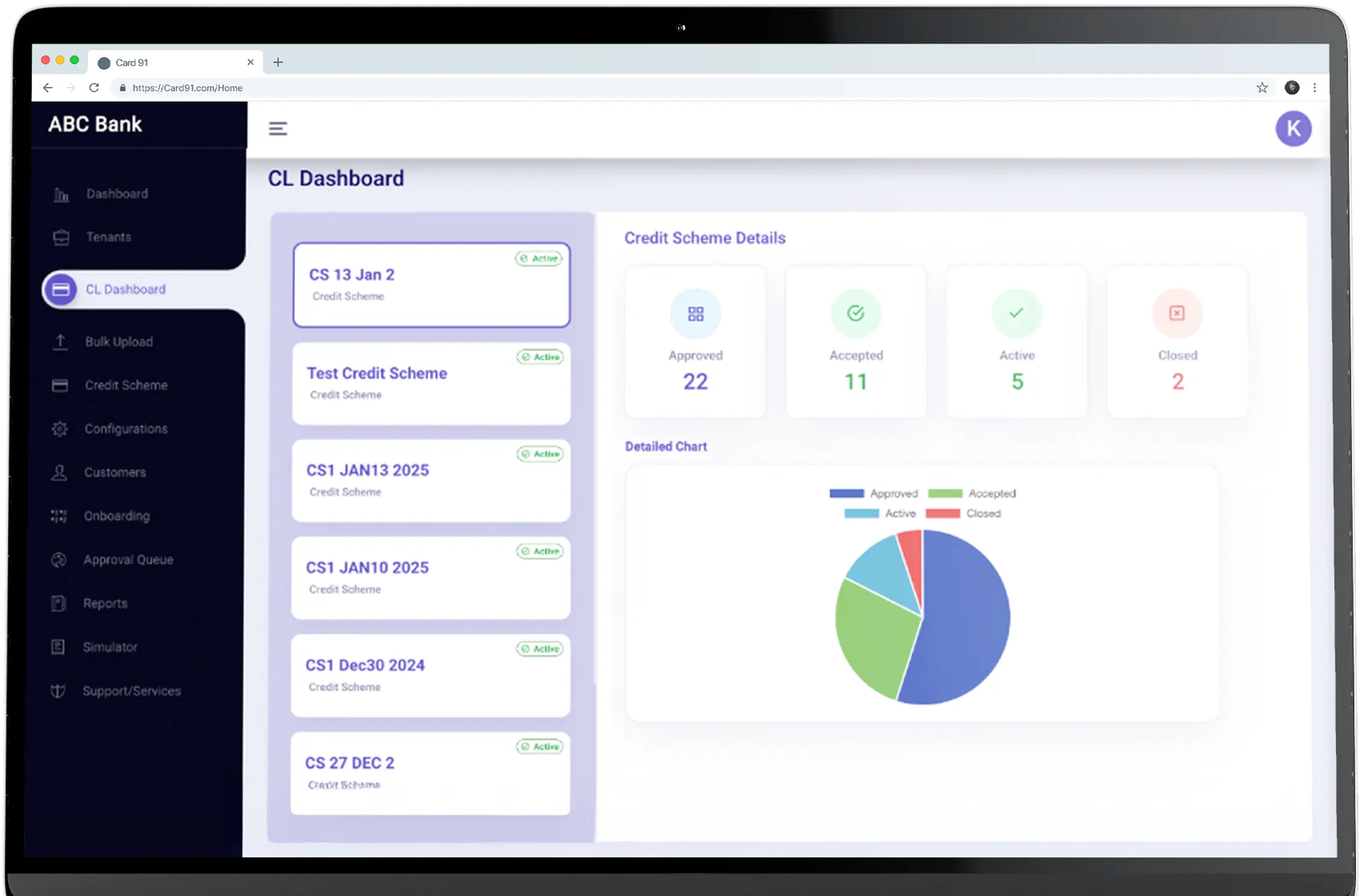

Intuitive, easy-to-use issuer portal:

To create credit schemes using our highly configurable template setup. To assign manage pre-sanctioned credit lines.

Our Credit Line Management System enables Credit Line Account Lifecycle Management via APIs for discovery, activation and usage.

You're always in the driver's seat - set or reset MCC-level end-use controls and transaction velocity or value controls as and when you need.

Manage all your portfolio actions such as Increasing or decreasing credit limits, suspending credit limits, and closing credit limits based on periodic review.

Record and manage customer consent required to extend credit line or increase credit line as mandated by the RBI’s Digital Lending Guidelines.

Offering a secured credit line? We have the provision to capture security reference details or integrate with the bank's existing collateral management system.

Allow your customers to choose the EMI option before or after the transaction on the UPI Third Party Application provider or on the customer portal.

Engineered for high throughput at the UPI-order of magnitude. Scalable as per requirement.

Reliable performance with industry-leading uptime, ensuring your operations never stop.

Minimise technical declines to ensure a seamless and optimal payment experience for your customers.

UPI Transactions processed at lightning speed.

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io