Revolutionising Credit Offerings Through Credit Line on UPI

UPI has emerged as India’s preferred payment method, constituting >75%* of the nation’s digital payment by volume. So far, UPI transactions were supported by various funding accounts like savings accounts, overdraft accounts, prepaid wallets, and Rupay Credit Cards. Now, a new addition has entered the UPI ecosystem.

Effective April 6th, 2023, the RBI has authorised Scheduled Commercial Banks to facilitate UPI payments using pre-sanctioned credit lines. According to the circular, “It is now proposed to expand the scope of UPI by enabling transfer to / from pre-sanctioned credit lines at banks, in addition to deposit accounts. In other words, UPI network will facilitate payments financed by credit from banks. This can reduce the cost of such offerings and help in development of unique products for Indian markets.” **

Credit Line on UPI gives the retail banking customer access to credit in the most convenient fashion – no long-drawn onboarding process, no learning curve and doesn’t take up space in their wallet. In short, a pre-sanctioned credit line simply works like the extension of an existing banking relationship. Coupled with UPI which is the most accessible, powerful, and easy-to-use payment channel in the country, it provides a seamless and efficient way to perform transactions that is sure to bring more citizens into the fold of credit.

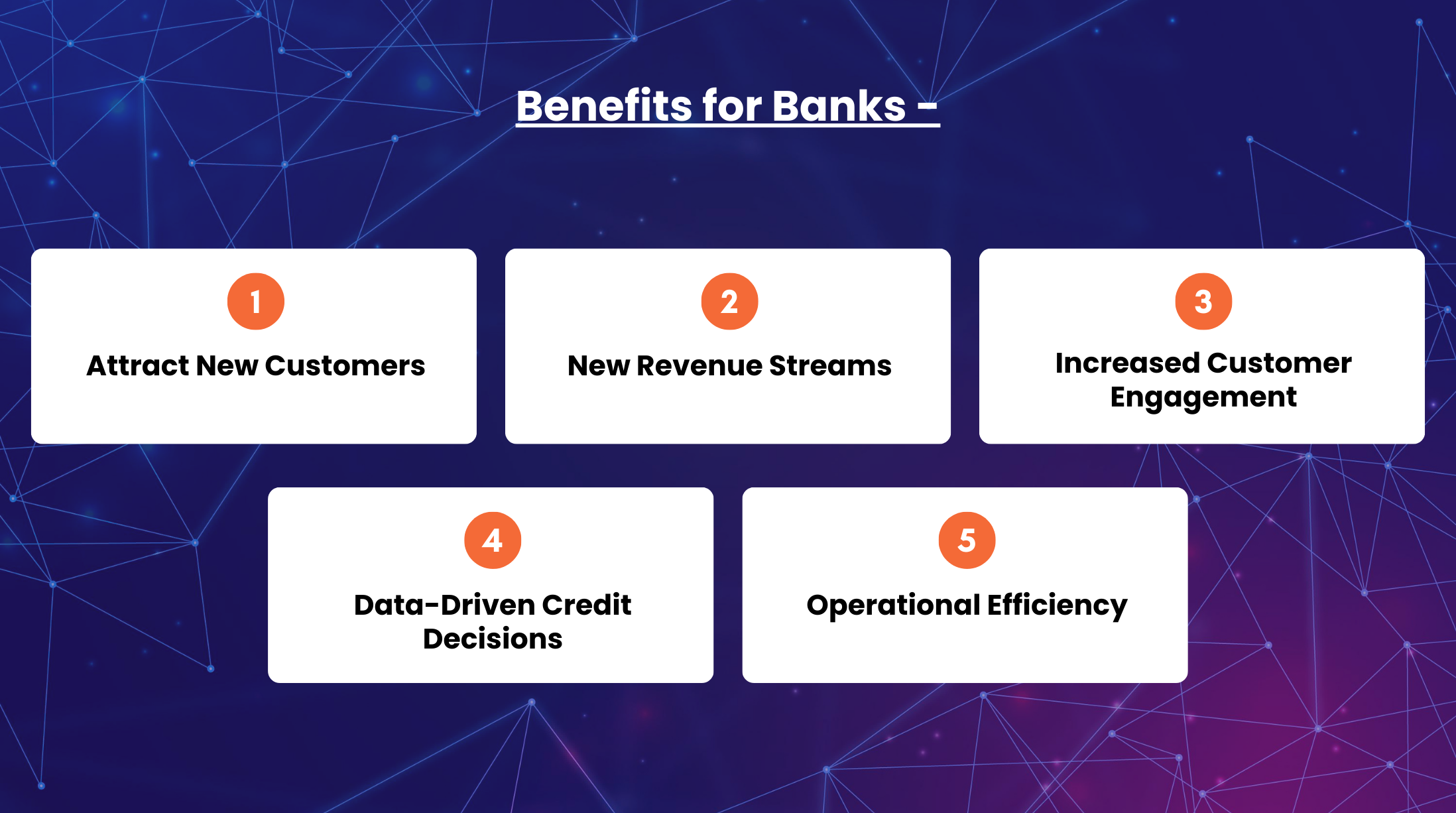

For the banks, this presents a new business avenue by unlocking an additional revenue stream with better unit economics, thanks to lower operational overhead. However, for the banks, taking Credit Line on UPI functionality live is not without challenges – the existing Loan Management Systems do not necessarily allow management of Revolving Limit, customising Credit Card Management System to suit the needs of the Credit Line product can be cumbersome and the existing Core Banking System for Overdraft might not be able to handle the required throughput.

This is why banks need a modern, modular, scalable and highly configurable solution that supports a variety of credit line product types. CARD91’s Credit Line Management System offers everything your bank needs to take Credit Line on UPI live for your customers.

Our Credit Line Management System is guided by three principles:

- Highly Configurability: CARD91’s highly configurable CLMS platform enables issuers to design and customise credit schemes, supporting various product types including interest-free, interest-bearing, fixed-term loans, and revolving credit to cater to diverse target segments.

- Modularity: Our modular framework empowers issuers to effortlessly customise, expand, and integrate features, ensuring a solution that can evolve with your dynamic business requirements.

- Regulatorily Compliance: CARD91’s CLMS platform is compliant with the regulator’s guidelines pertaining to digital lending. Our configurable setup makes adapting to new regulations a breeze.

What’s more?

> Easily integrate with your banking systems: CARD91’s CLMS allows seamless incorporation of Credit Line on UPI workflows into your existing banking processes. This includes easy management of credit lines through your issuer portal and seamless integration of CARD91’s SDKs with your mobile app/net banking.

> Certified for UPI 2.0: Our UPI switch is NPCI-certified for UPI 2.0 and is pre-integrated with CARD91’s credit line management system. If the bank already uses a UPI switch, it can be seamlessly integrated with our CLMS.

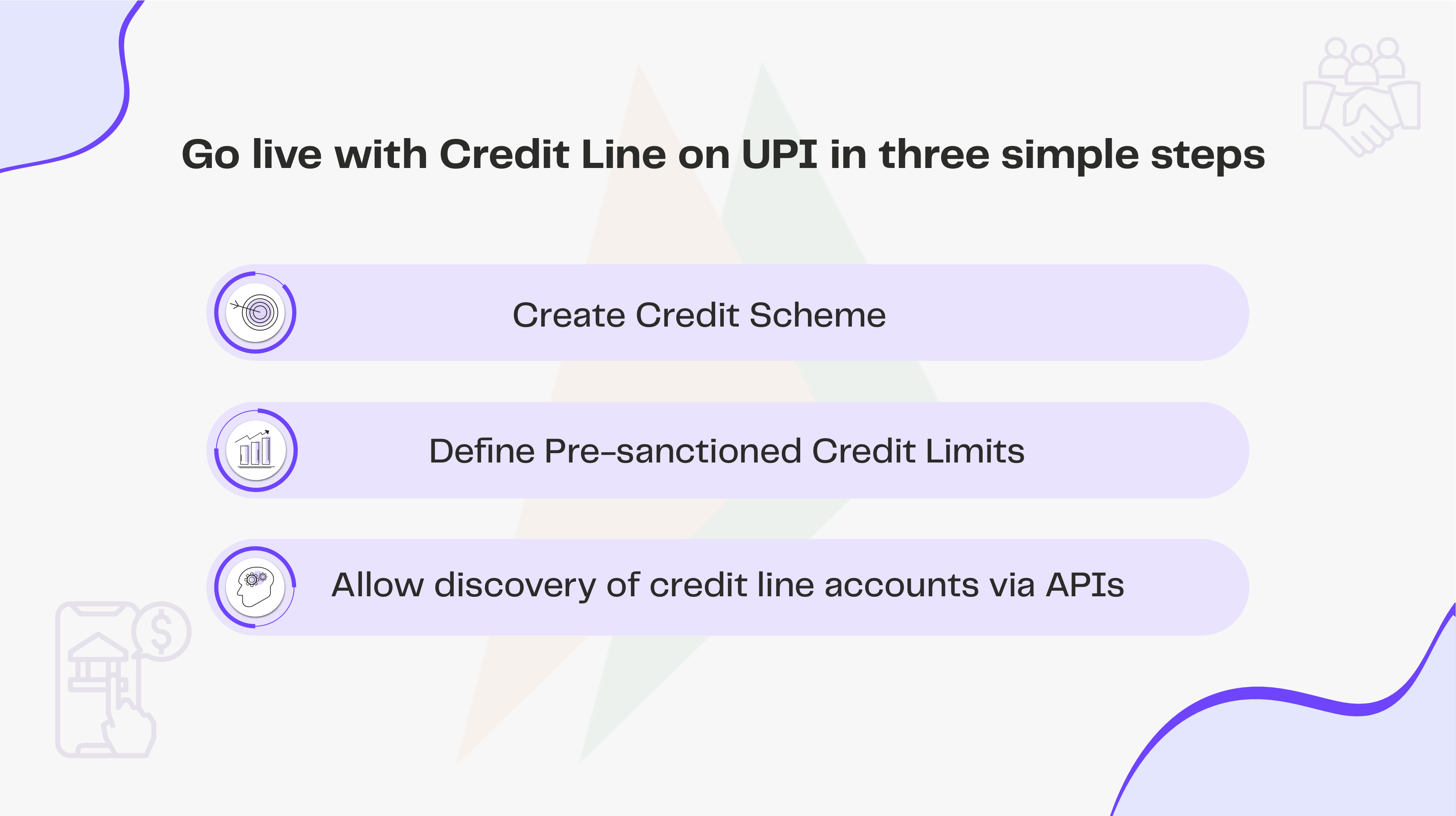

This is how your bank can go live with Credit Line on UPI in three simple steps using CARD91’s Credit Line Management System:

- Create Credit Scheme

Create a credit scheme on the CLMS portal by defining the credit line product type, account type, and associated templates for fees, billing, EMI, etc.

2. Define Pre-sanctioned Credit Limits

Assign pre-sanctioned credit limits for customers via Bulk Upload / APIs and seek consent before the customer can avail the credit line.

3. Allow discovery of credit line accounts via APIs

Our Account Management APIs facilitate comprehensive credit line lifecycle management, encompassing the discovery, activation, and usage of Credit Line on UPI.

In embracing Credit Line on UPI, banks can leverage the transformative shift happening in India’s digital payment landscape. The potential impact this can bring about is three-fold:

- CL on UPI can open up access to credit in rural India through sachet credit line offerings, thereby creating a new wave of financial inclusion.

- ETB customers who are non-users of any credit facility, but uses UPI can now be nudged to use Credit Line on UPI, given how simple and effortless the shift is.

- Through purpose-based lending that Credit Line on UPI offers (powered by CARD91’s CLMS Transaction Control Module), banks can ensure that the credit usage happens for the intended purpose.

By leveraging UPI’s widespread adoption and integrating pre-sanctioned credit lines seamlessly into everyday transactions, banks not only enhance customer convenience but also unlock new avenues for revenue growth.

CARD91’s Credit Line Management System offers a robust framework to Issuer Banks to navigate these complexities brought about in managing Pre-sanctioned Credit Lines as per board policy and empower them to pioneer this next evolution in retail banking.

Sources:

* https://redseer.com/newsletters/trends-reshaping-indias-payment-landscape/

** https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=55473 and https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12532&Mode=0

Authored by Praveen Varghese, Product Manager at CARD91