Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.

Traditional credit scores are no longer enough.

In an era where millions transact daily through UPI but remain invisible to credit bureaus, banks need a smarter, real-time credit evaluation model designed for digital ecosystems.

That’s where UPI-based behavioural credit scoring and UPI-based lending come in—using live transaction data to assess risk, unlock lending, and drive financial inclusion.

In this blog, we’ll explore how banks can cut defaults, grow approvals, and tap into untapped segments—all through the power of CARD91’s AI-powered credit engine for UPI credit scoring.

Traditional credit evaluation has failed to evolve with the digital consumer. Here’s why legacy credit models are struggling in today’s digital lending environment:

Credit bureaus update their records infrequently, which means lenders may be assessing applicants based on months-old data. This creates a blind spot in fast-paced, real-time credit evaluation in India.

India has millions of digitally active users—especially in the gig economy—who lack formal credit histories. Legacy models simply filter them out, limiting financial inclusion and stalling UPI-based lending.

Without behavioural insights, lenders often group diverse borrowers into the same risk category. This leads to poor underwriting, higher NPAs, and misaligned credit limits.

UPI-based credit scoring uses AI and machine learning to analyze real-time UPI transaction data. It looks at payment behaviour—frequency, patterns, peer-to-peer transfers, bill payments, and more—to build a dynamic behavioural credit score.

UPI activity reflects how individuals manage day-to-day finances in real time. It’s dynamic, data-rich, and more indicative of actual repayment capacity than static credit bureau scores—perfect for digital lending using UPI data.

Unlike bureau scores that update monthly or quarterly, UPI-based behavioural scores adapt daily—enabling banks to operate with real-time credit evaluation in India for smarter decision-making.

Catch risk signals early through spending anomalies, sudden inactivity, or irregular payment patterns. This helps mitigate delinquencies before they snowball—reducing losses in UPI-based lending portfolios.

AI-driven insights eliminate manual dependencies. CARD91’s AI-powered credit engine ensures faster, consistent underwriting—ideal for digital lending using UPI data.

By scoring and segmenting more accurately, banks can approve more loans while maintaining tight control on portfolio quality.

Reach thin-file, self-employed, and new-to-credit individuals confidently—backed by real-time behavioural insights.

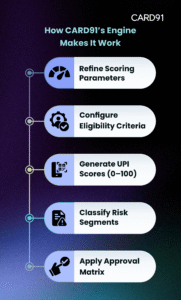

CARD91’s UPI Credit Score Engine is built for precision, speed, and inclusion—making UPI-based lending a reality at scale. Here’s how the AI-powered credit engine functions:

CARD91’s behavioural scoring engine is already driving success in real-world UPI-based lending environments:

In a world where UPI transactions are the new credit signals, traditional credit scores are falling behind.

CARD91’s AI-powered credit engine for UPI credit scoring brings precision, inclusion, and speed to modern digital lending workflows—helping you lower defaults, expand access, and lend confidently.

The future of lending is behavioural.

Book a demo today and see how CARD91 is shaping the next era of UPI-based lending in India.

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io