AI-led merchant onboarding enables real-time risk assessment and fraud detection, offering banks a compliant, scalable solution.

Create, assign, & manage VPAs for merchants to streamline UPI collections and ensure seamless transaction mapping.

Accept payments via PPI, credit card, credit line, and savings account.

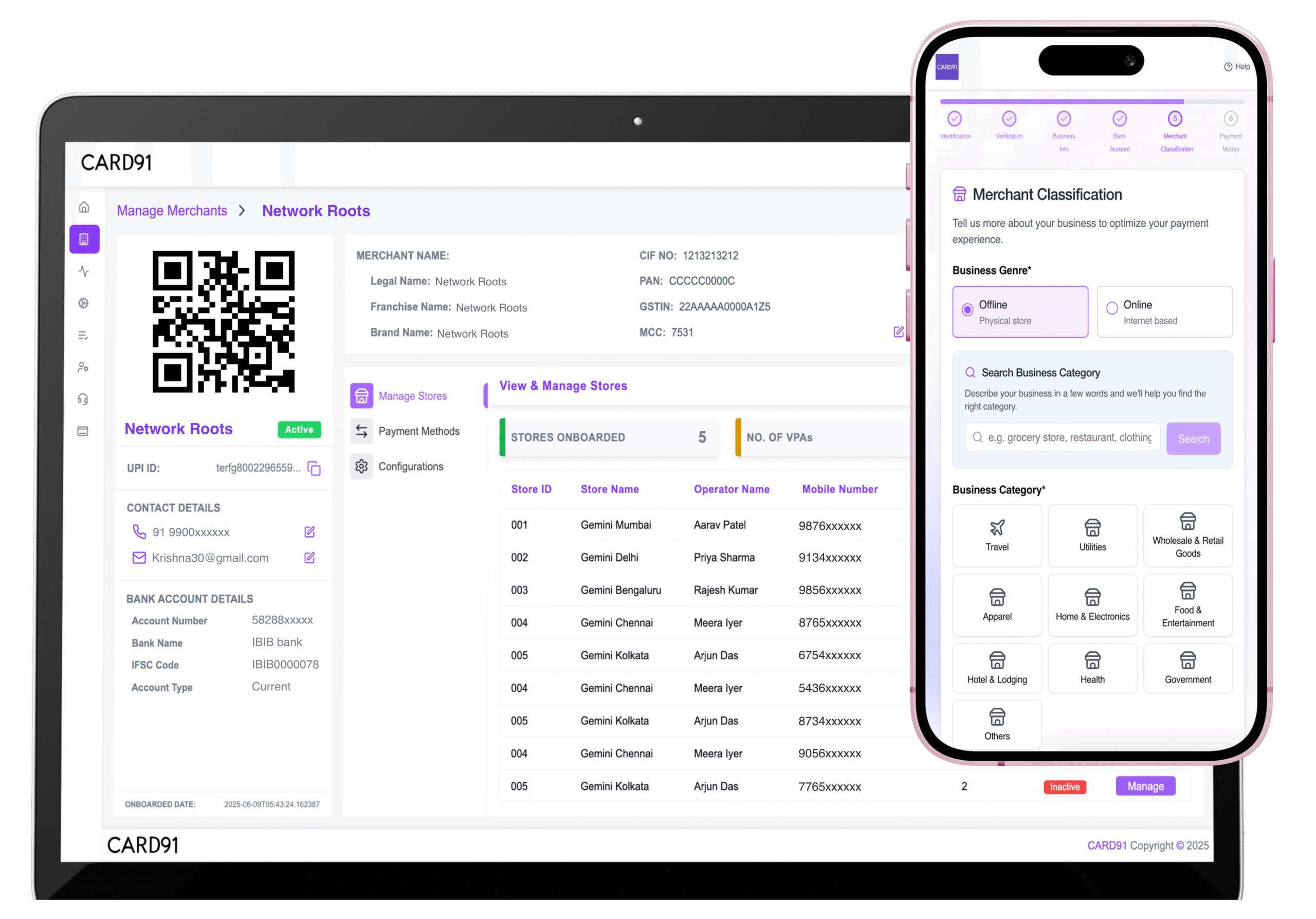

Add or edit stores, manage terminals, and generate store-level VPAs effortlessly.

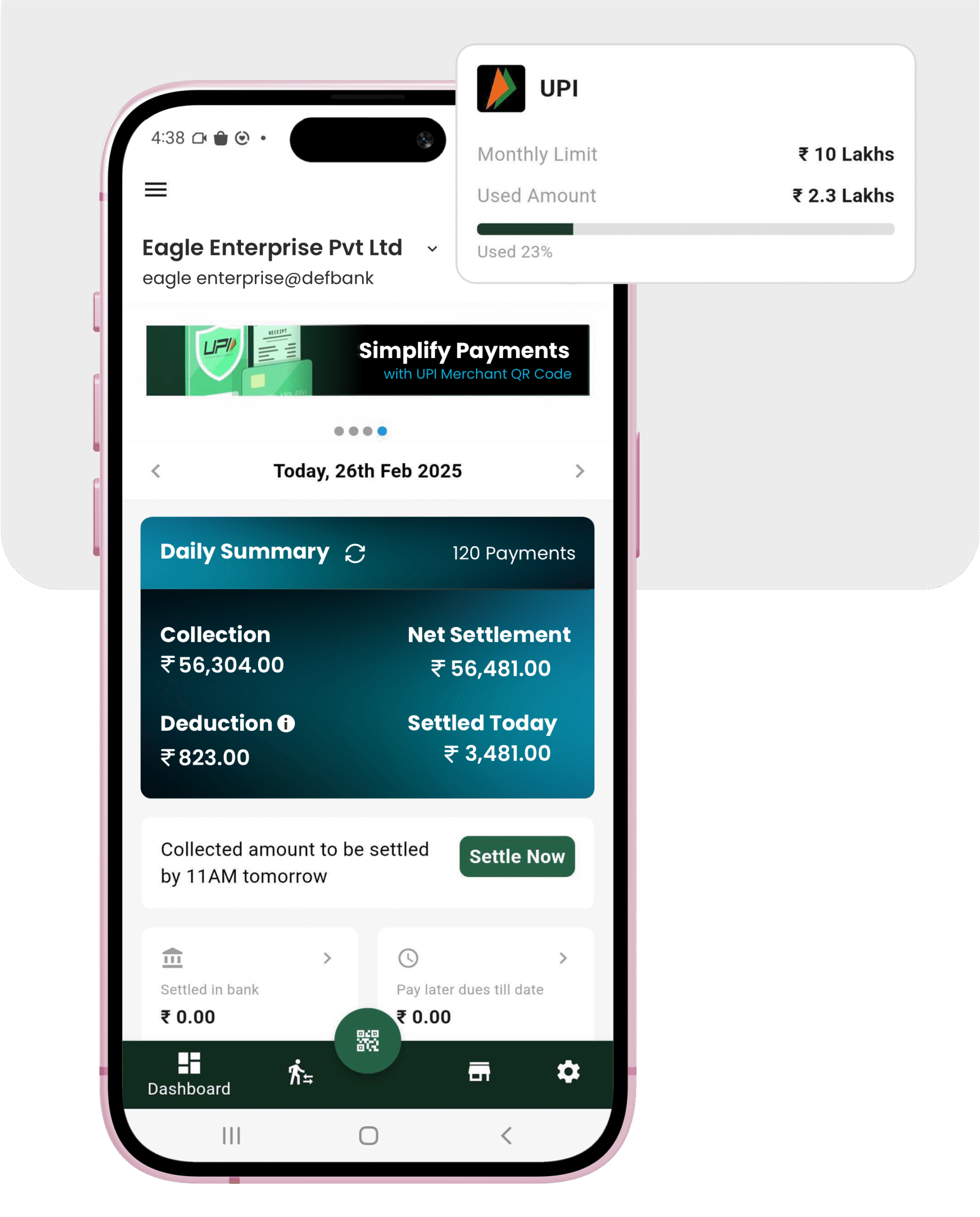

Track collected payments, MDR deductions, taxes, and net settlements with ease.

Trigger refunds individually or in bulk directly through the portal.

Define your settlement cycles and initiate them manually when needed.

Set up mandates, send pre-debit notifications, and execute or revoke them in a few clicks.

Track throughput, latency, success rates, BD%, and TD% in real time.

Use a centralized control center to manage all merchant activities.

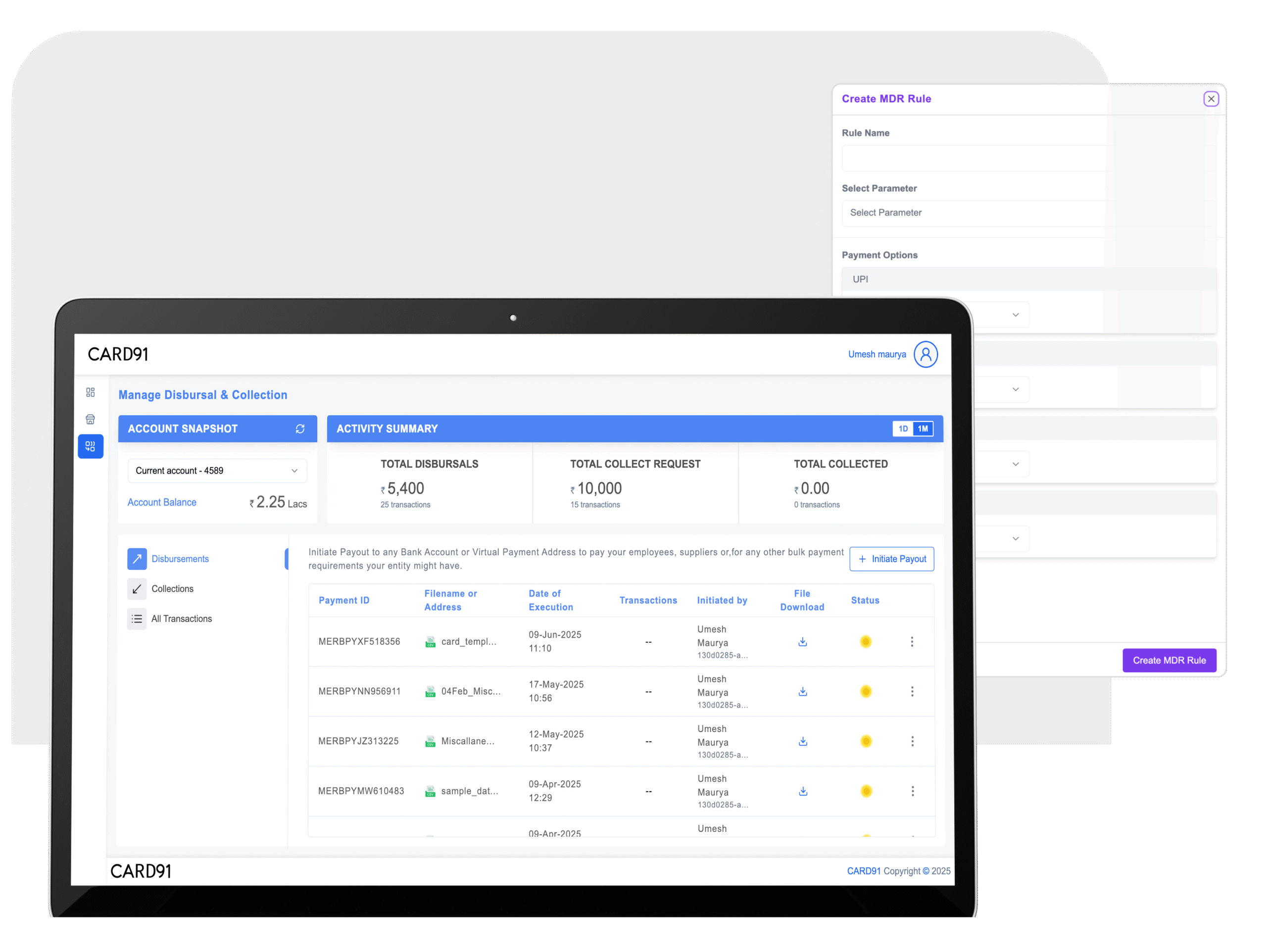

Set MDR, limits, settlement cadence, charges, and subscription plans.

Generate pre-defined and custom reports as per your needs.

Manage roles, permissions, and user access with ease.

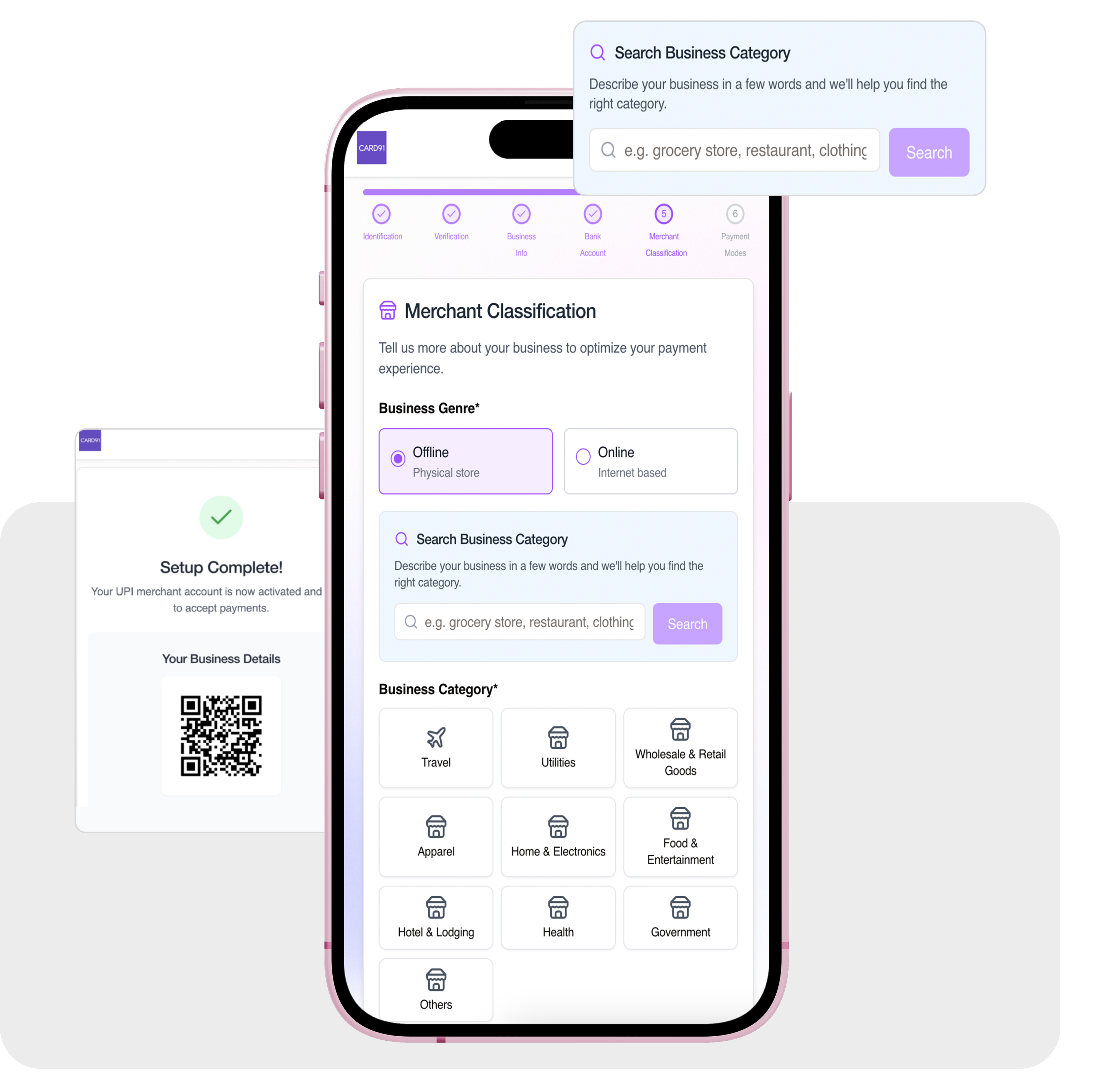

Onboard merchants in minutes with automated checks (GSTIN, PAN, Udhyam) and instant VPA/QR generation.

AI/LLM models assign accurate MCCs, score merchant risk, and flag suspicious profiles—ensuring AML and KYB compliance with ease.

Track performance, configure MDR and limits, manage roles, and access real-time reports—all from one centralized portal.

Enable merchants to manage stores, collections, refunds, settlements, and mandates via mobile SDKs or web dashboard.

Automate high-volume disbursals and collections with dynamic VPAs, payment links, mandate setups, and end-to-end reconciliation.

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io