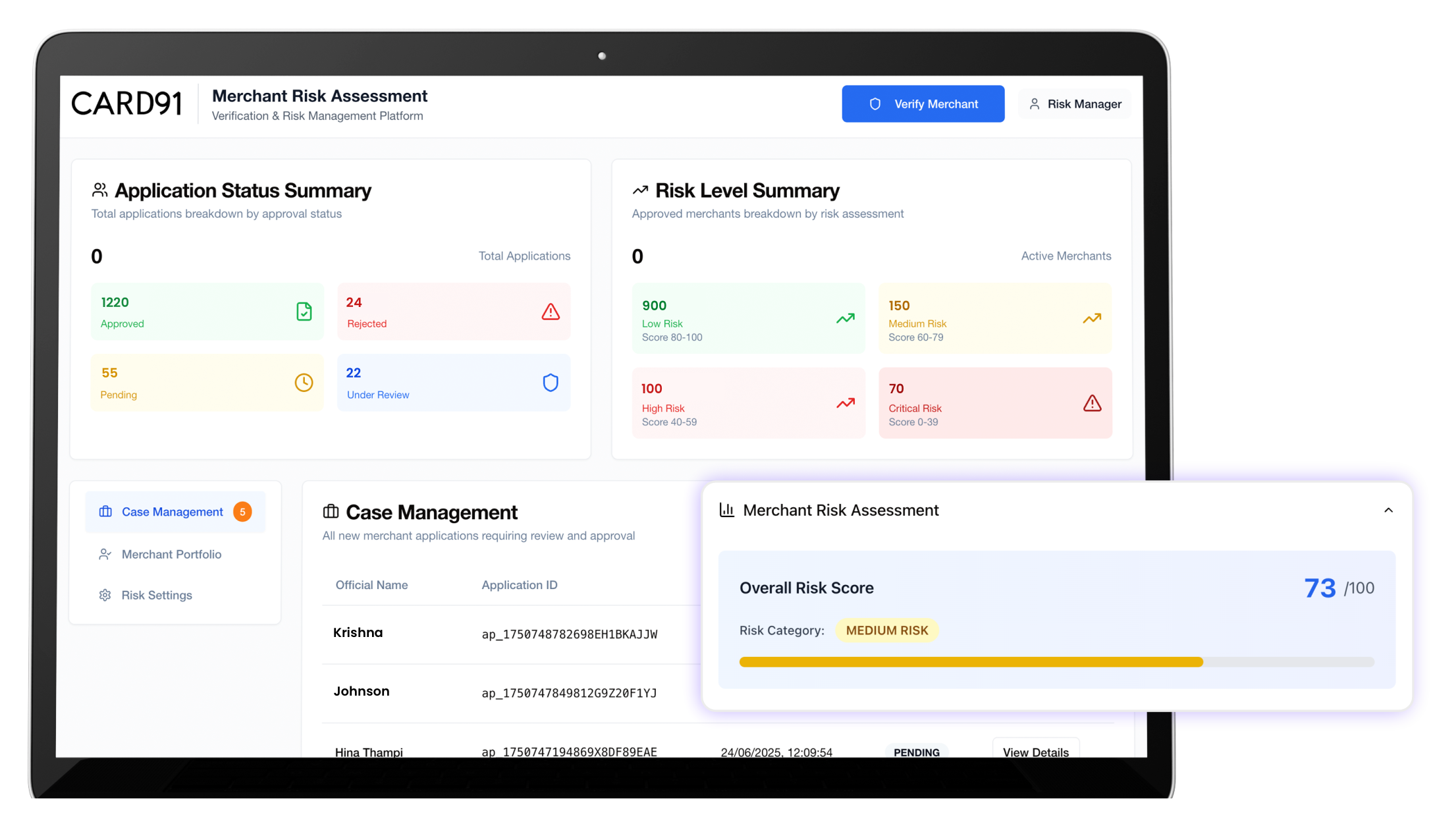

A smart and intelligent risk assessment solution for Banks and NBFCs to evaluate the risk of Merchants, MSMEs, and Corporates during onboarding.

Validates business credentials using trusted sources, including GSTIN, CIN, Udhyam Certificate, and Shop & Establishment records.

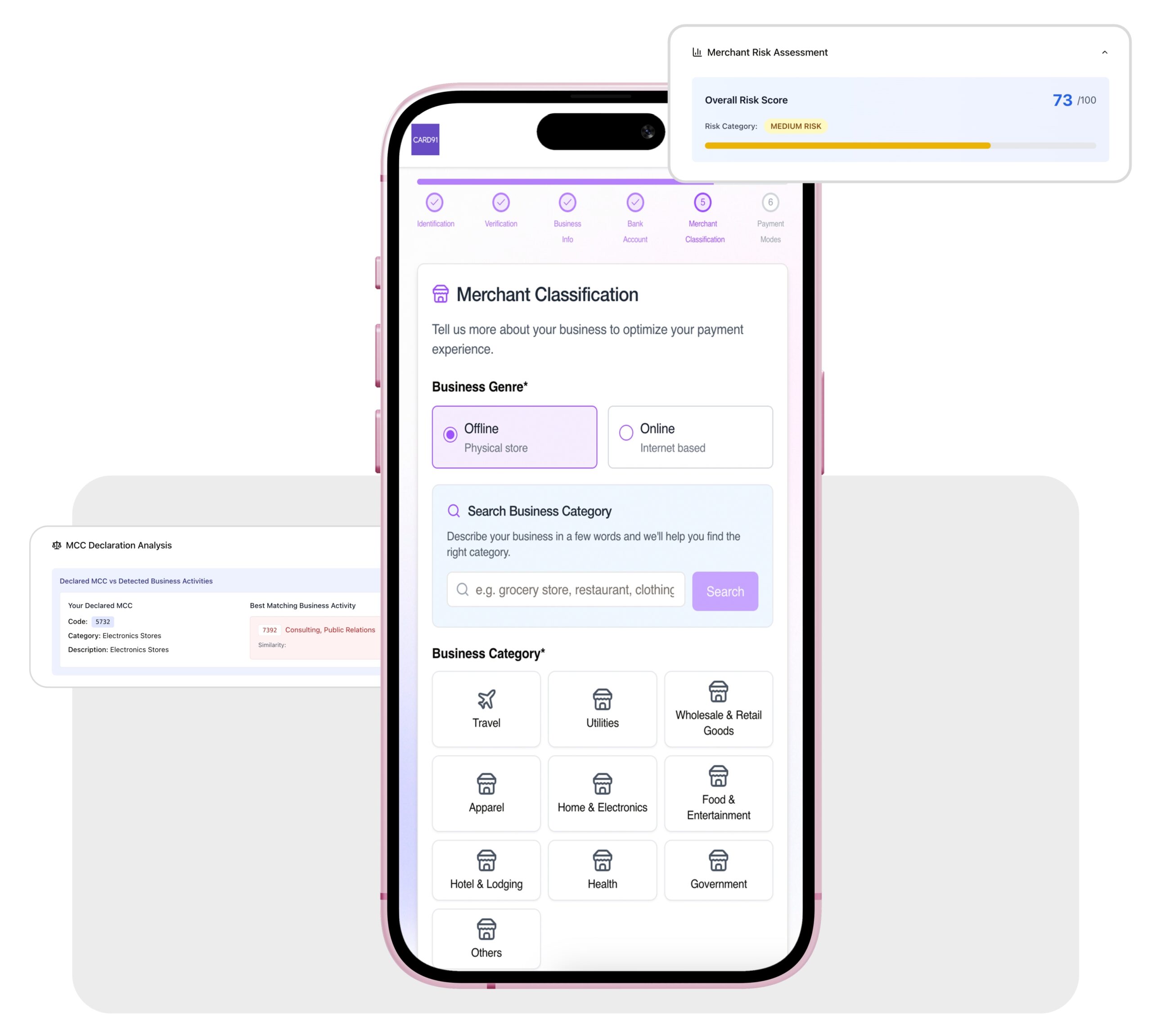

We leverage over 30 signals to generate a risk-adjusted weighted score for each business through our AI/ML model.

Validate the legitimacy of businesses, both offline and online using our advanced tech capabilities. We employ digital maps and street view images for offline and web crawling techniques for online verification.

Fully configurable workflow rules that let you define automated actions - approve, decline or review - to streamline operations.

Employs advanced natural language search to accurately assign MCC codes, and dynamically set transaction and collection limits based on the merchant’s risk score.

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io