Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.

Reimagining merchant onboarding for a smarter, faster digital economy.

India’s payments landscape is expanding rapidly, with millions of new merchants joining digital platforms each year. Yet, slow manual verification, MCC errors, and fragmented KYB checks continue to block scalability. Each misclassified merchant exposes banks and PSPs to revenue loss, compliance risk, and operational delays.

To grow sustainably, the ecosystem needs automation driven by intelligence. That’s where CARD91’s BlitzTrust brings transformation.

Accurate verification is the foundation of trust between banks, acquirers, and merchants. Before activation, credentials such as PAN, GSTIN, and Udyam must be verified and classified under the correct MCC (Merchant Category Code).

MCC mapping influences interchange fees, pricing logic, settlement flows, and regulatory compliance.

Manual errors cause revenue leakage and misreporting; automated systems prevent these risks—turning compliance into a competitive advantage.

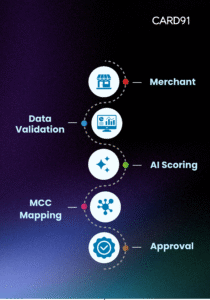

BlitzTrust is an AI/ML-powered Merchant Verification & Classification Suite that automates every onboarding layer—from PAN/GSTIN validation to dynamic MCC assignment—within seconds.

Core Features

BlitzTrust turns complex workflows into one intelligent, auditable process.

Banks, PSPs, and acquirers today face intense pressure to balance regulatory compliance with speed of execution. BlitzTrust empowers them to do both.

With its AI-driven automation, what once took days can now be completed in minutes. Merchant verification, classification, and activation happen seamlessly without the delays of manual checks.

The accuracy achieved by the platform virtually eliminates MCC misclassifications—ensuring precise billing, transparent interchange logic, and error-free settlements.

Financial institutions that deploy BlitzTrust also experience a marked reduction in manual effort and operational overheads. The platform’s intelligence-led approach helps teams work faster, detect inconsistencies early, and focus on growth instead of repetitive validation tasks.

Most importantly, onboarding processes stay fully compliant with RBI, NPCI, and AML/KYC guidelines, enabling institutions to grow their merchant base confidently and securely.

BlitzTrust ensures every verification is traceable and RBI-compliant:

When compliance and intelligence work together, scaling safely becomes effortless.

In India’s fast-digitising economy, the ability to onboard merchants swiftly and securely defines competitiveness.

BlitzTrust empowers banks and fintechs to achieve speed, accuracy, and compliance in one platform—turning every verified merchant into a trusted connection in India’s digital commerce fabric.

Accelerate Merchant Onboarding with BlitzTrust

Discover how CARD91’s AI-powered Merchant Verification & Classification suite simplifies onboarding while boosting accuracy and compliance.

Explore BlitzTrust | Book a Demo

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io