CARD91 helps regulated institutions make the right product, regulatory, and ecosystem decisions upfront—grounded in experience supporting issuer-grade payment programs at scale. We ensure payment programs are structured to launch cleanly, scale safely, and remain audit-ready.

Every regulated payment program is only as strong as its weakest early decision.

Weakness at any stage surfaces later as launch delays, regulatory escalation, or operational instability.

CARD91 provides structured advisory across the full decision lifecycle—ensuring each layer is validated before moving forward.

Define the right program construct and opportunity—assessing product type, target segments, differentiation, demand signals, and launch readiness within regulatory and sponsor-bank constraints.

Convert strategy into a decision-ready blueprint covering scope, user journeys, pricing and commercial logic, control points, and unit economics—without premature technology execution.

Design regulator-ready ecosystems by structuring issuer and sponsor relationships, selecting payment rails, defining partner roles, and setting clear accountability across onboarding, settlement, disputes, and reporting.

Embed regulatory feasibility directly into program design—clarifying KYC/AML responsibility, risk ownership, audit readiness, controls, and reporting obligations. CARD91 does not act as a regulator, auditor, or compliance certifier.

Design operating workflows, approvals, escalation paths, and measurable controls to ensure day-2 readiness—covering exceptions, incident handling, and regulatory visibility.

Guide implementation planning and enablement—informing integration approach, system responsibilities, and rollout sequencing aligned to regulated infrastructure patterns. Execution ownership remains with the institution and its delivery partners.

CARD91’s advisory teams bring 100+ years of collective experience across regulated payment programs. Supported by strong academic foundations, including IIT Kanpur, our advisors work one-on-one with leadership teams to validate critical decisions—ensuring programs are structured to launch cleanly, scale responsibly, and remain audit-ready.

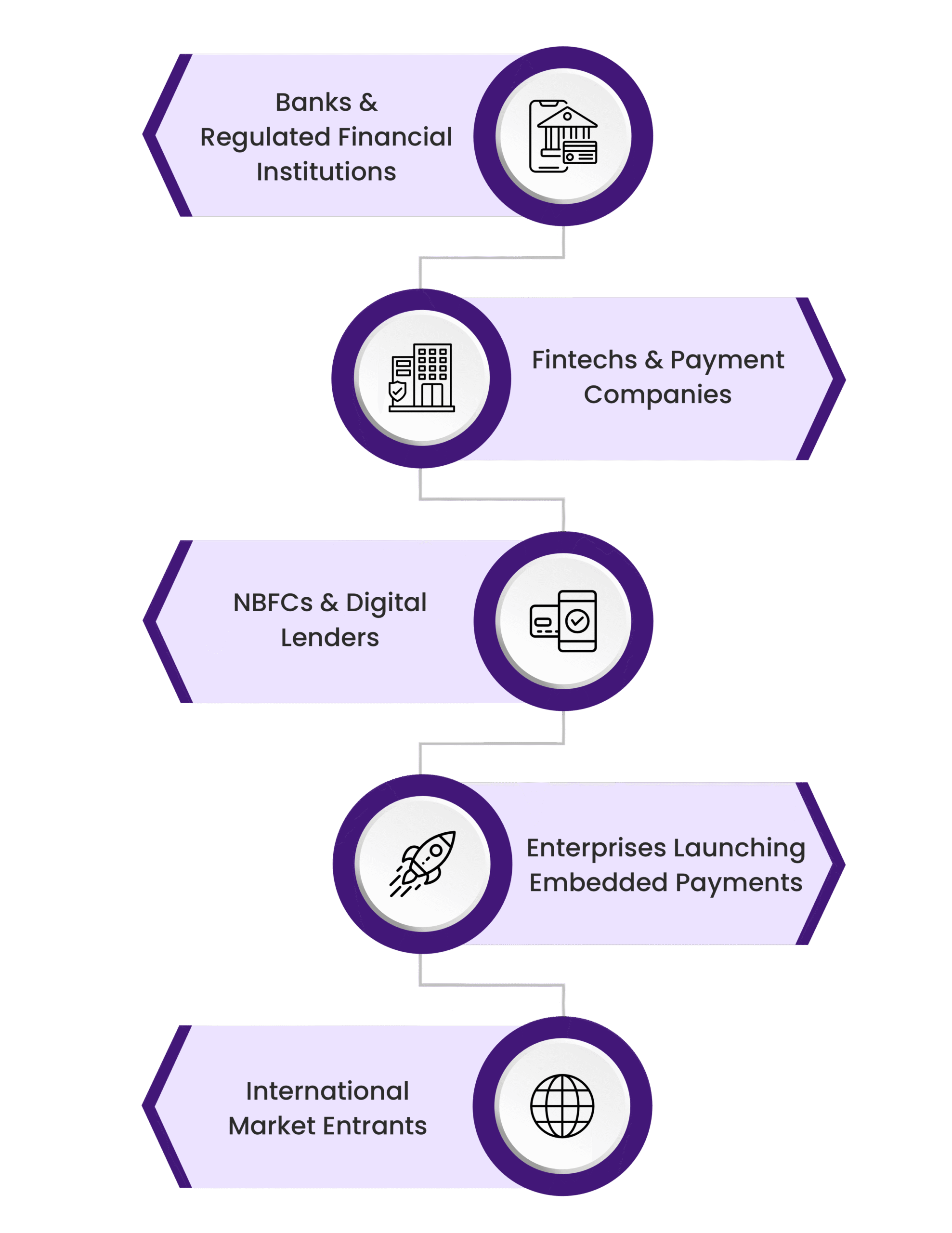

Supporting compliant design and scale of issuer-led payment programs with clear regulatory ownership and audit readiness.

Structuring payment products with defined sponsor-bank accountability and scalable operating models.

Enabling controlled credit and payment programs within clearly defined risk and compliance boundaries as portfolios scale.

Designing cards, loyalty, and embedded payment programs without regulatory ambiguity.

Advising global institutions on launching compliant payment programs within India’s regulated payment ecosystem.

Connect one-on-one with CARD91’s advisory team to validate critical payment decisions — before regulatory, financial, or execution risk compounds.

Submission of an inquiry through this website does not create a client, advisory, fiduciary, or contractual relationship. Any such relationship shall arise only upon execution of a formal written agreement. Confidential information shared during consultations will be handled in accordance with applicable confidentiality agreements.

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io