Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.

How India’s lenders are transforming credit decisions through real-time behavioural scoring.

For decades, lending in India has revolved around a single question — “What does the bureau say?”

Credit bureaus like CIBIL, Experian, and Equifax have formed the backbone of the country’s formal credit ecosystem, evaluating borrower reliability through past repayment records and outstanding obligations.

But as India’s financial landscape evolved—driven by digital payments, gig work, and diversified income streams—this traditional bureau-based model began to show its limitations. Millions of individuals, despite being financially active, remain “thin-file” customers, invisible to the formal credit system because they have no traditional loans or credit cards.

This gap has left more than 150 million adults unscored or under-scored. For lenders, this represents not just a challenge but also a massive opportunity. The question now is:

Can creditworthiness be assessed fairly without historical borrowing data?

The answer lies in behavioural intelligence powered by UPI data.

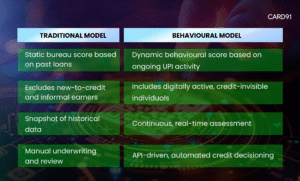

Traditional credit scoring models focus on past borrowing behaviour, but in today’s digital-first economy, transaction behaviour is a much more accurate indicator of financial intent.

Behavioural underwriting shifts the focus from “What have you borrowed?” to “How do you manage your money?”

By analysing UPI transaction data—such as payment frequency, spending categories, and cash-flow consistency—lenders can derive powerful insights into a person’s financial discipline and repayment capability.

This approach allows financial institutions to move beyond static bureau data and instead rely on real-time behavioural signals, creating a more inclusive and predictive credit ecosystem.

UPI (Unified Payments Interface) has transformed how India pays, earns, and saves. With over 13 billion monthly transactions, UPI reflects behavioural trends across every income group—from salaried employees in metros to self-employed merchants in tier-2 cities.

For lenders, this dataset provides unparalleled depth and diversity of insights:

Essentially, UPI activity is a behavioural fingerprint—revealing intent, consistency, and reliability—three core attributes of modern creditworthiness.

To help lenders leverage this behavioural intelligence, CARD91 has built BlitzScore, an AI-driven UPI Credit Score Engine that converts raw transaction data into real-time, actionable credit insights.

With BlitzScore, lenders can finally reach new-to-credit and self-employed individuals confidently—unlocking inclusion while maintaining credit quality.

This transformation doesn’t replace traditional bureaus—it enhances them. By layering behavioural intelligence over existing credit data, lenders achieve a 360-degree risk view, blending historical reliability with current intent.

By proactively addressing these challenges, BlitzScore simplifies adoption—allowing lenders to modernise without technical friction.

India’s credit ecosystem is entering an era where behavioural intelligence drives financial inclusion. As UPI expands and digital payments mature, behavioural scoring will become the cornerstone of future credit models.

In this evolving landscape:

BlitzScore represents the first step toward this reality—where creditworthiness reflects behaviour, not just borrowing history.

The next wave of lending in India will belong to institutions that embrace real-time behavioural intelligence.

By unlocking the potential of UPI data through CARD91’s BlitzScore, lenders can make smarter, faster, and more inclusive credit decisions—reshaping the future of financial trust.

Because in a digital-first India, behaviour is the new collateral.

Discover how CARD91’s UPI Credit Score Engine – BlitzScore helps you underwrite smarter and faster. Learn More or Book a Demo

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io