Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.

India’s financial landscape is transforming rapidly, driven by the digital revolution. Yet, access to formal credit remains one of the most persistent barriers to financial inclusion. Millions of individuals — gig workers, freelancers, students, and small business owners — remain “thin-file” customers, largely invisible to traditional credit bureaus.

However, these same individuals are active participants in India’s thriving digital economy through the Unified Payments Interface (UPI). Every digital transaction — whether bill payments, merchant purchases, or peer-to-peer transfers — reveals authentic behavioural patterns that reflect financial discipline and intent.

This evolving landscape presents a vital question:

Can verified UPI data become a reliable indicator of creditworthiness for India’s new-to-credit population?

The answer lies in CARD91’s UPI Credit Score Engine — BlitzScore.

These figures underscore a single reality — India’s payment data holds the key to unlocking its next wave of credit inclusion.

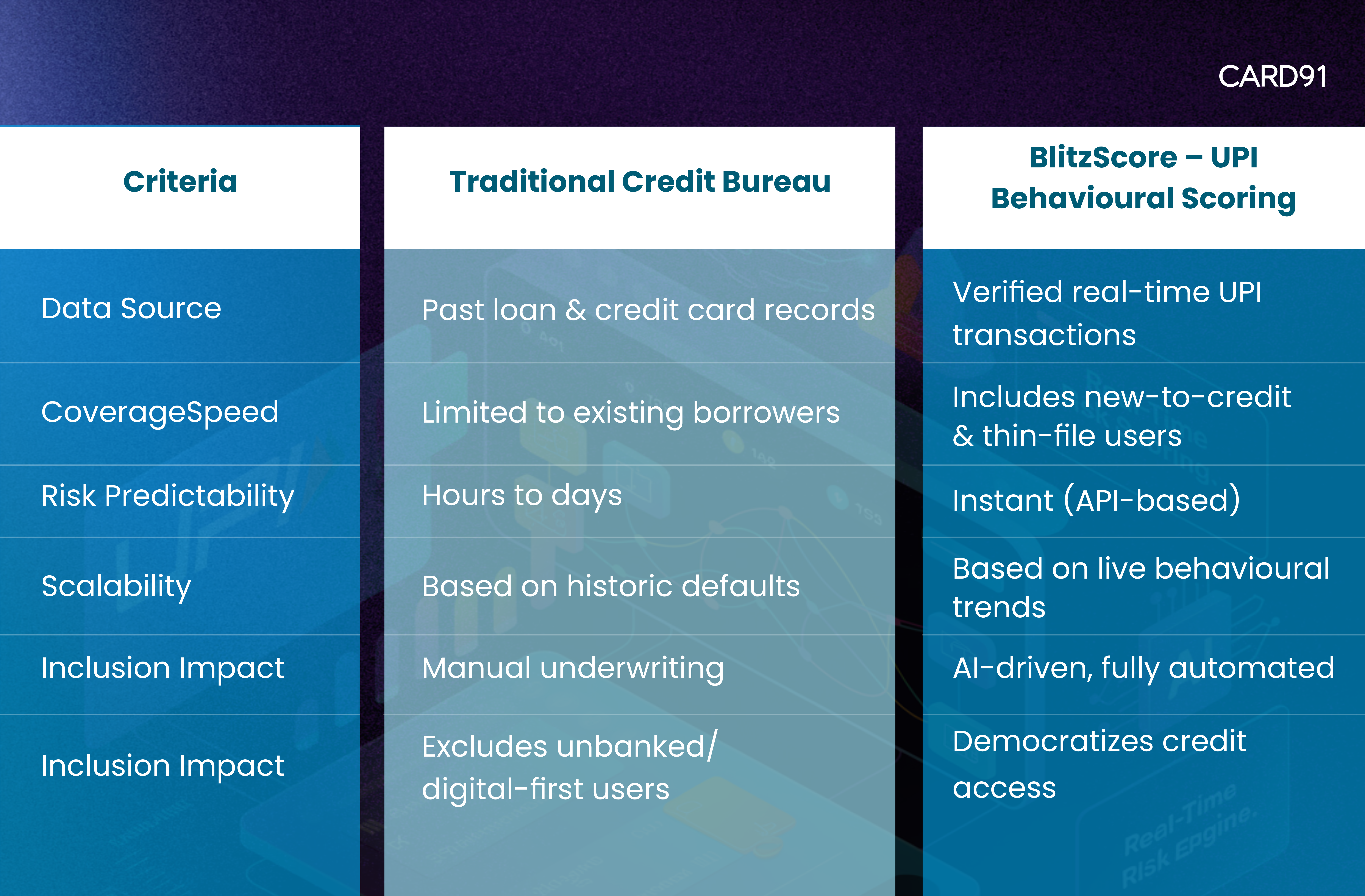

Traditional credit scoring models depend on static bureau data and past loan histories. They fail to capture real-time financial behaviour, excluding customers who lack prior credit exposure.

Behavioural credit scoring changes this paradigm by analysing ongoing transaction data to evaluate spending consistency, repayment intent, and financial discipline.

In India, UPI provides an unparalleled behavioural dataset, processing over 13 billion transactions each month. It paints a real-time picture of how individuals manage money — frequency of payments, bill regularity, and diversity of transactions.

By focusing on how individuals transact rather than whether they have borrowed before, behavioural scoring empowers lenders to serve a broader and fairer customer base.

BlitzScore, developed by CARD91, is a proprietary behavioural scoring engine designed to translate verified UPI activity into measurable, real-time credit intelligence. It bridges the gap between digital payment behaviour and credit eligibility through advanced AI and ML models, ensuring accuracy, compliance, and scalability.

![]()

![]()

![]()

![]()

Millions of financially active users without bureau records can now be assessed fairly using verified UPI data. BlitzScore empowers lenders to confidently expand credit access to these segments while maintaining strong risk control.

Lenders can process thousands of behavioural scores per second, reducing approval times from days to seconds. This creates a competitive edge in digital-first loan journeys.

Behavioural signals detect early warnings — such as sudden inactivity or irregular transaction spikes — enabling proactive portfolio management.

BlitzScore’s models evolve dynamically with each transaction stream, making it ideal for products like BNPL, micro-loans, and credit-on-UPI offerings.

As a regulated infrastructure provider, CARD91 ensures that BlitzScore operates within RBI’s consent-based and data protection frameworks.

All transaction data is:

This ensures lenders gain valuable behavioural insights without compromising customer privacy or regulatory integrity.

The future of credit in India is real-time, inclusive, and data-driven.

As UPI transforms payments, BlitzScore is redefining credit evaluation — enabling lenders to underwrite with precision, fairness, and speed.

By leveraging UPI behavioural intelligence, financial institutions can bridge the gap between digital activity and credit trustworthiness, driving India closer to true credit inclusion.

Because when behaviour speaks louder than history, trust becomes measurable.

Ready to underwrite the next billion credit users?

Discover how CARD91’s UPI Credit Score Engine (BlitzScore) can power inclusive lending innovation Learn More about BlitzScore or Request a Demo

UPI-based behavioural scoring analyses verified UPI transaction data — frequency, diversity, and consistency — to assess creditworthiness and repayment intent. It enables lenders to make faster, data-driven, and inclusive decisions.

BlitzScore generates a behavioural score (0–100) in seconds, using real UPI data. Lenders can confidently approve borrowers without traditional bureau histories — especially gig workers, students, and freelancers.

Yes. BlitzScore operates under RBI’s consent-based and PCI-DSS standards, ensuring encryption, anonymization, and secure storage of all UPI data.

It delivers real-time, inclusive, and dynamic insights, helping lenders detect risk earlier, reduce default rates, and onboard more customers efficiently.

Banks, NBFCs, fintechs, BNPL platforms, and microfinance institutions can all leverage BlitzScore to underwrite new borrowers effectively while maintaining compliance.

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io