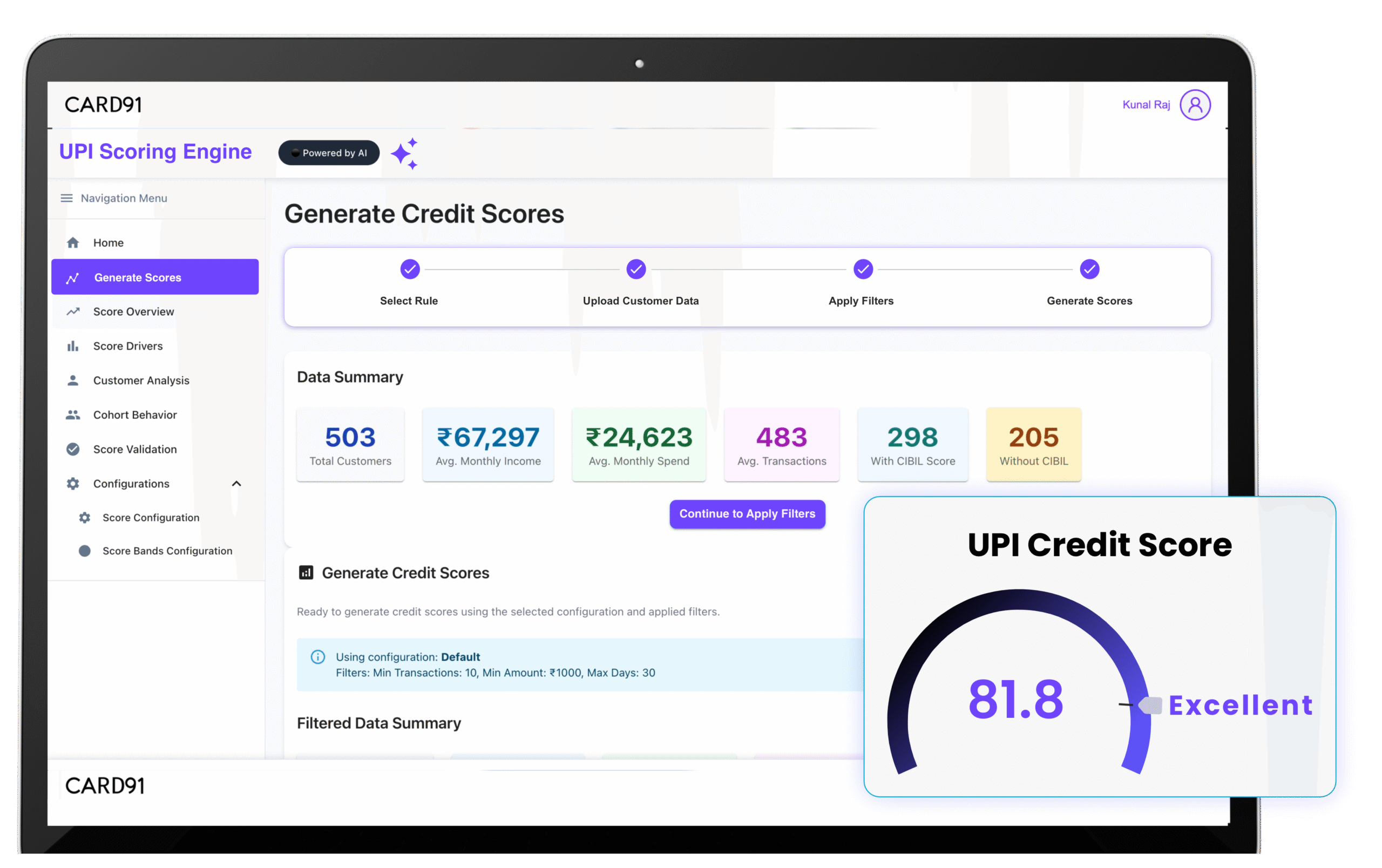

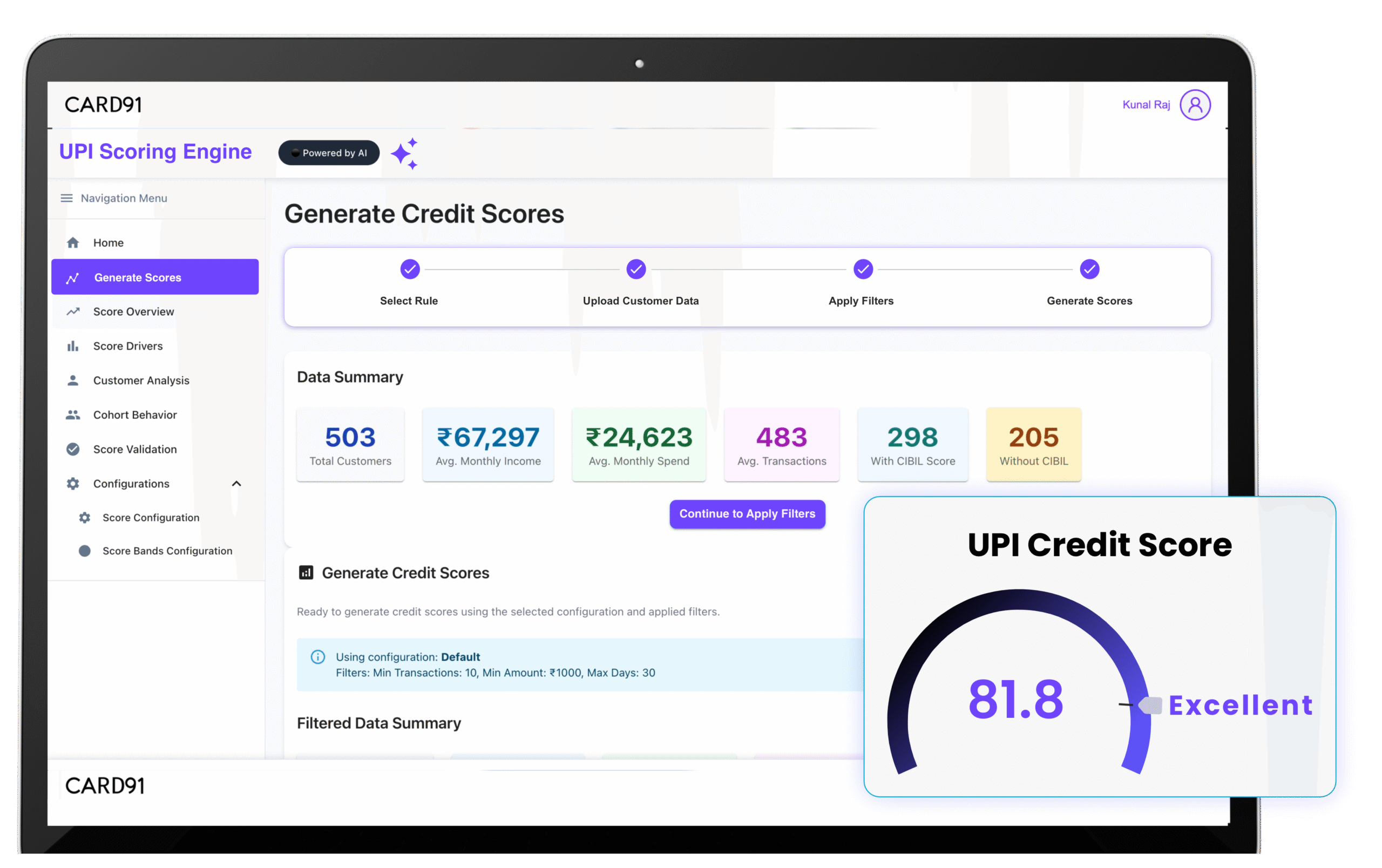

AI/ML-driven behavioural credit scoring engine that leverages UPI transaction data to deliver actionable insights for informed and inclusive lending decisions.

Generate a behavioural credit score (0–100) based on machine learning analysis of UPI transaction data.

Facilitate seamless onboarding with on-demand or batch-based score computation.

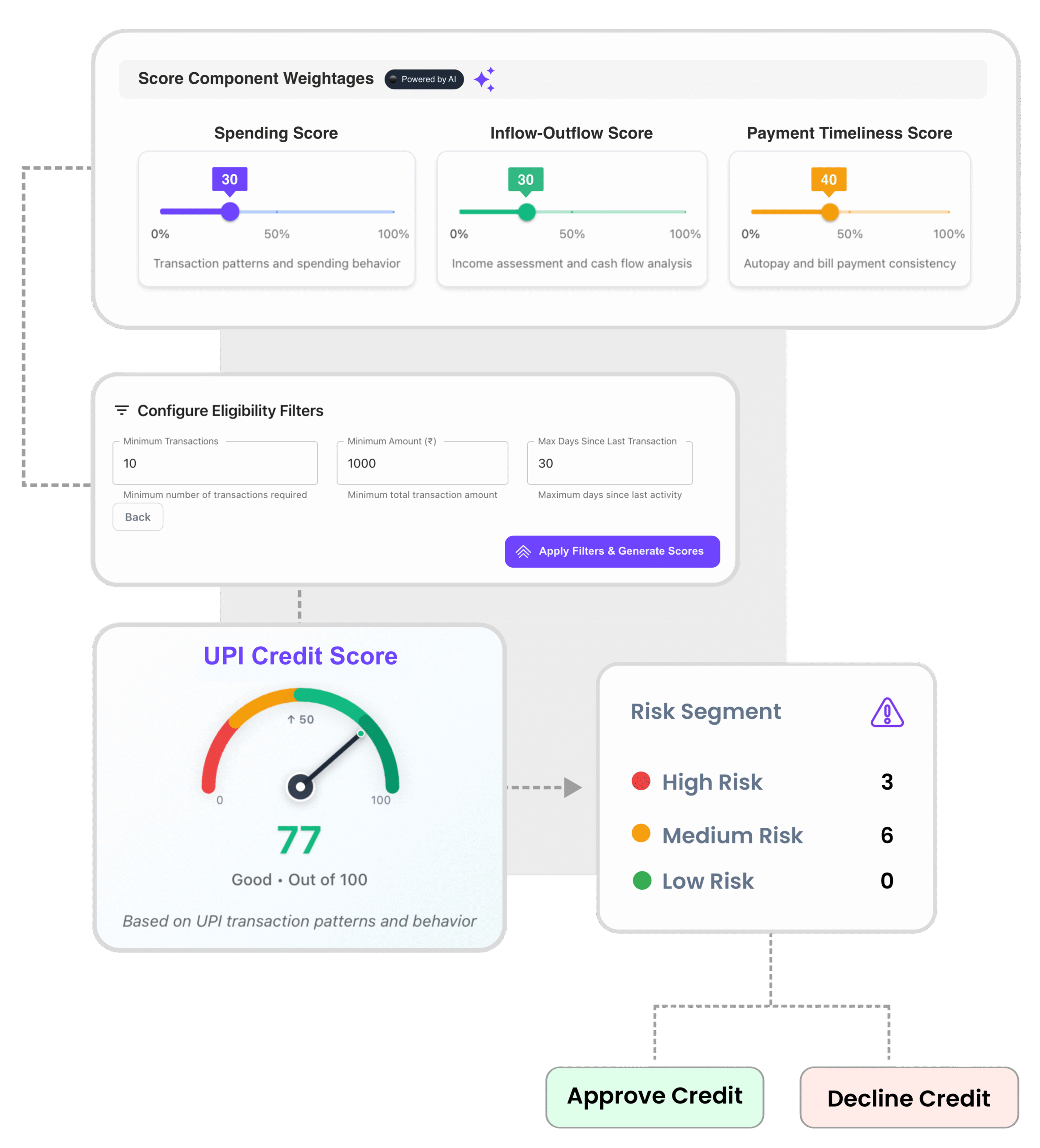

Apply configurable risk thresholds to automate approvals, trigger manual reviews, or decline applications.

Customize baseline criteria such as income, demographic details, transaction details to define target segments.

Benchmark the BRE Score alongside traditional credit bureau ratings to assess credit uplift and risk segmentation.

Enable access to credit for individuals lacking traditional credit bureau history.

Utilize real-time UPI behavioural data to enhance underwriting precision and mitigate default risk.

Increase approval rates and lifetime value by targeting high-potential customer segments with greater accuracy.

Evaluate customers with thin-file or no bureau records using behavioural transaction data.

Enhance decision-making speed and accuracy by utilizing dynamic behavioural data over static credit reports.

Meet financial inclusion goals by responsibly expanding credit to underserved segments.

AI/ML models evaluate historical UPI data to determine optimal variables and weightages.

Establish minimum income, transaction details, demographic details to filter relevant customer profiles.

Compute a credit score (0–100) for each customer either individually or in bulk.

Segment customers into High, Medium, or Low risk groups based on scoring thresholds.

Link each segment to corresponding decision rules for approval, review, or rejection.

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io