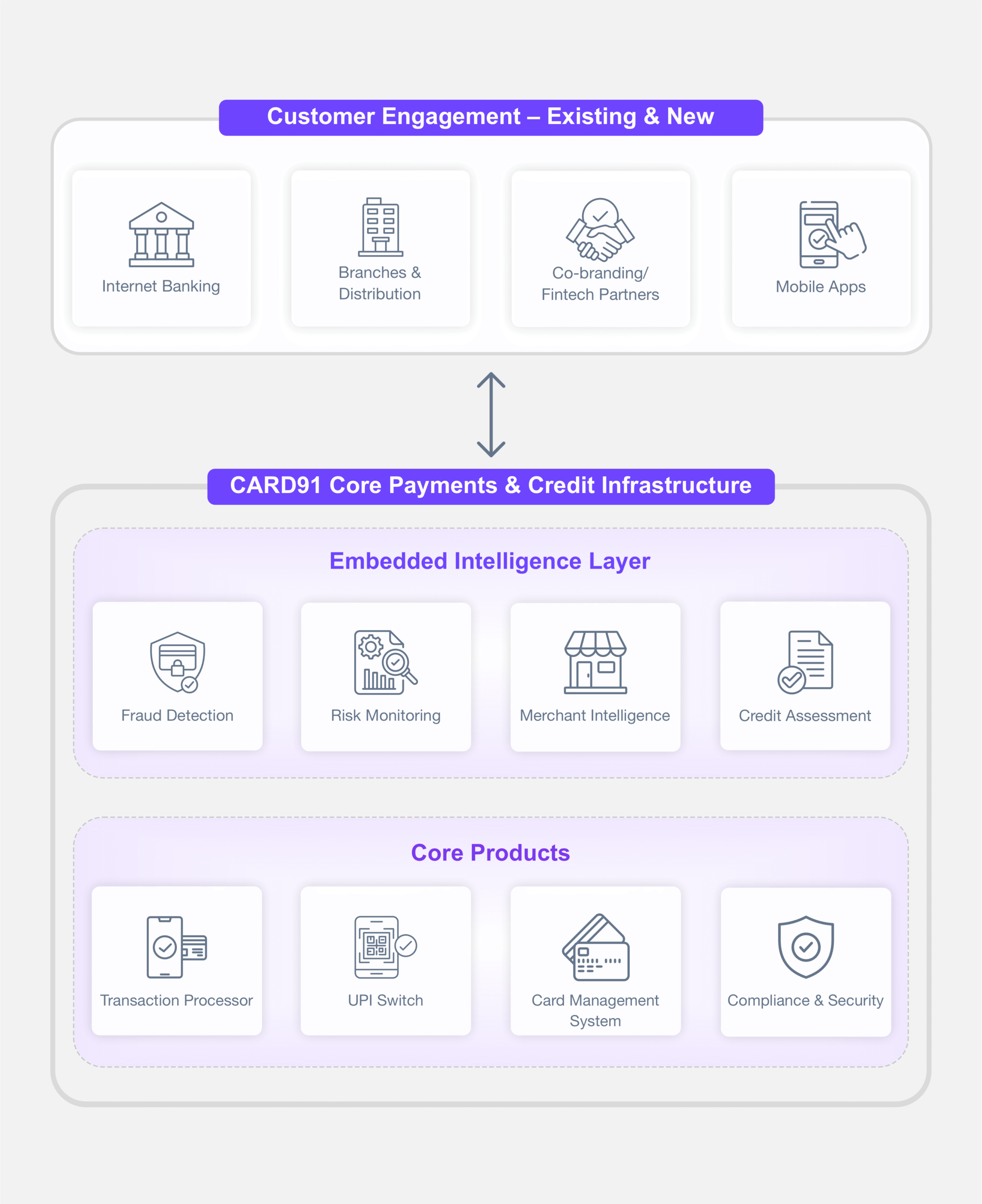

AI-led fraud detection, real-time risk monitoring, and behaviour-based risk assessment—built as native extensions of CARD91’s payments & credit infrastructure for banks, NBFCs, and regulated fintechs operating within RBI and NPCI frameworks.

Identify and mitigate fraud risks across onboarding, transactions, and credit usage through continuous, risk-based monitoring.

Enable ongoing transaction-level and behavioural risk monitoring without impacting system performance.

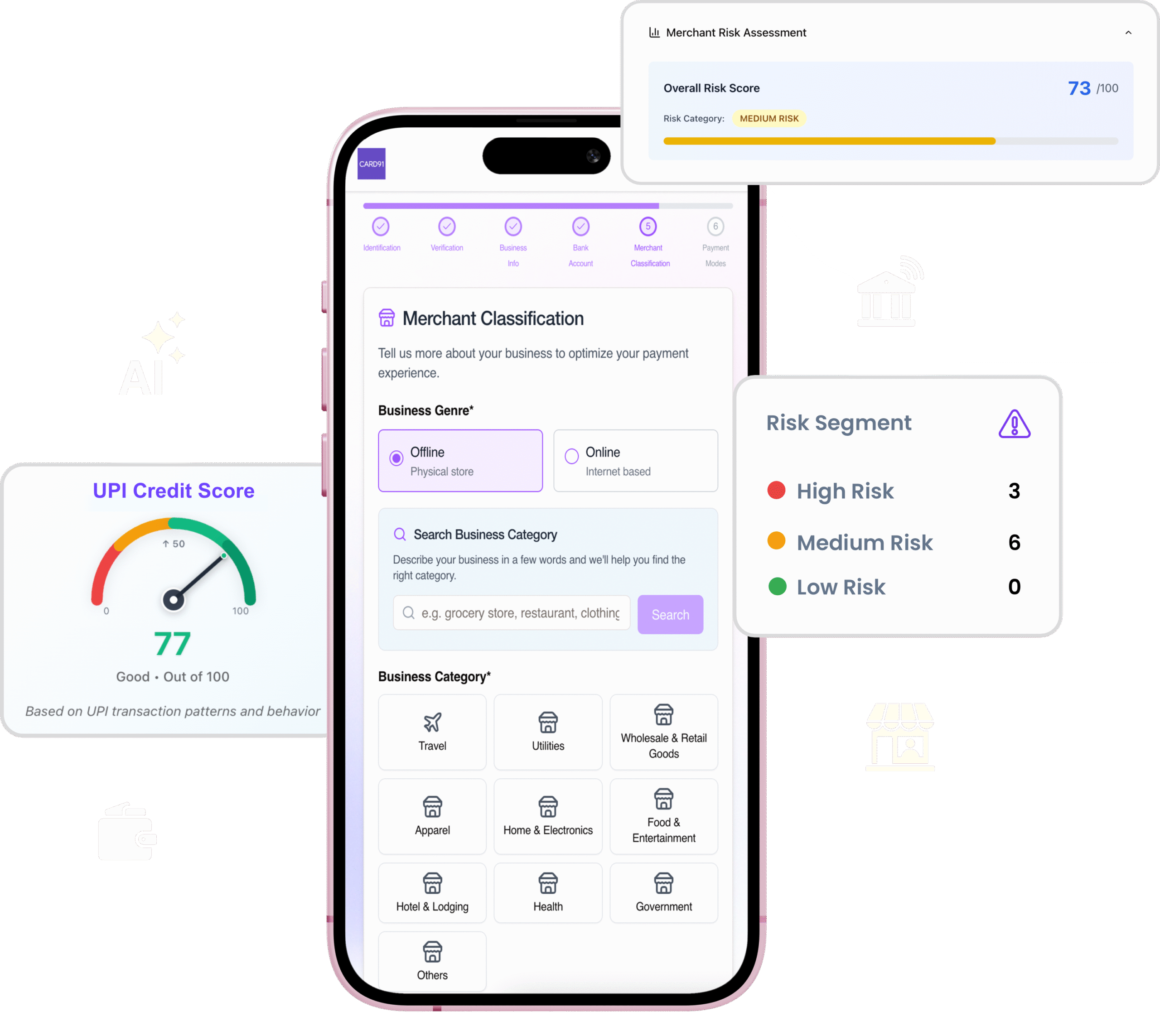

Strengthen merchant and customer due diligence through structured verification, consistent KYB classification, and periodic validation.

Support controlled credit deployment, including Credit Line on UPI, through usage-based assessment and exposure controls.

Operate at national scale with traceable, auditable controls aligned with RBI guidelines and NPCI requirements.

AI-driven merchant verification and MCC classification designed to help issuers and acquirers:

Built in alignment with RBI & NPCI guidelines.

An AI-led credit assessment engine for lenders across Personal Loans, Credit Cards, and Credit Line on UPI, enabling issuers to:

Designed for issuer-controlled underwriting, not black-box scoring.

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io