Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.

This blog explains CLOU architecture for banks, including issuer systems, UPI switch integration, and lifecycle orchestration.

As banks scale Credit Line on UPI (CLOU), architectural decisions quickly determine risk exposure, uptime, audit outcomes, and scalability.

The importance of these architectural choices becomes clearer when viewed alongside how banks implement Credit Line on UPI in practice, where system design directly impacts risk control, scalability, and regulatory readiness.

Many early CLOU implementations treat it as a payments extension—integrating UPI connectivity and enabling credit at the front end. In practice, this approach breaks under production loads.

Credit Line on UPI is an issuer-controlled credit system operating on real-time payment rails. It demands an architecture that unifies:

This article breaks down the issuer-grade CLOU architecture banks need to run Credit Line on UPI reliably at scale.

CLOU sits at the intersection of payments and lending, but behaves like neither.

As a result, CLOU architecture must support:

This requires a modular, API-first issuer stack.

These differences are also why CLOU and card-based credit cannot be treated as interchangeable rails, a distinction explained further in how banks design multi-rail credit portfolios on UPI.

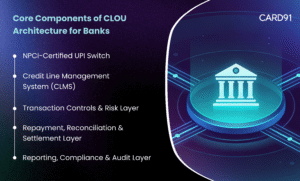

A production-ready CLOU architecture consists of five tightly integrated layers.

The UPI switch is the entry and exit point for all CLOU transactions.

For CLOU, the UPI switch must support:

Without a certified, production-grade UPI switch, CLOU cannot scale safely.

The CLMS is the heart of CLOU architecture.

It acts as the system of record and control for all credit line activity, managing:

During every CLOU transaction, the CLMS:

Without a CLMS, banks lose fine-grained control over credit exposure.

In issuer-grade deployments, this central role of the CLMS reflects why banks need a dedicated Credit Line Management System for Credit Line on UPI, rather than relying on loan or card platforms.

CLOU requires pre-authorisation risk enforcement, not post-facto checks.

This layer applies:

Unlike card systems, CLOU controls operate at the account and scheme level, allowing banks to tailor risk logic precisely.

CLOU repayments are UPI-native, flowing into a unique UPI handle per credit line.

This layer handles:

A tightly integrated reconciliation layer is critical to avoid:

Because these controls must execute before authorisation, banks design this layer around real-time risk governance for Credit Line on UPI, not post-transaction review mechanisms.

CLOU operates under continuous regulatory scrutiny.

This layer supports:

Banks that design reporting as an afterthought often face operational bottlenecks and audit observations later.

A typical CLOU transaction follows this path:

Each step must be synchronous, resilient, and observable.

Banks must design CLOU architecture for:

Key best practices include:

CLOU failures are not just technical—they are reputational and regulatory risks.

CARD91 provides a homegrown, NPCI-certified UPI switch and a Credit Line Management System (Nimbus) designed to operate as a unified CLOU stack.

With CARD91’s architecture, banks benefit from:

This modular yet unified approach allows banks to retain full architectural control while accelerating CLOU deployment.

Credit Line on UPI is not a feature—it is core banking infrastructure.

Banks that succeed with CLOU:

In 2026 and beyond, issuer-grade CLOU architecture will be the difference between experimental rollouts and sustainable credit platforms.

Q: What is CLOU architecture for banks?

A: CLOU architecture refers to the issuer technology stack required to run Credit Line on UPI, including UPI switch, CLMS, controls, reconciliation, and reporting.

Q: Can banks reuse card or loan systems for CLOU?

A: Not effectively. CLOU requires real-time, account-based credit controls that traditional systems are not designed for.

Q: What is the most critical component of CLOU architecture?

A: The Credit Line Management System, as it governs the full lifecycle and risk controls.

Q: Planning to design or modernise your CLOU architecture?

A: See how CARD91’s UPI Switch and Credit Line Management System power issuer-grade Credit Line on UPI deployments. Book a Demo

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io