Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.

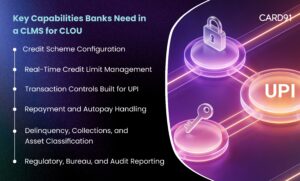

A credit line management system for banks is essential to control lifecycle, limits, repayments, and compliance for credit line on UPI.

As Credit Line on UPI (CLOU) moves into production across banks, many institutions initially attempt to manage it using existing loan systems or card management platforms.

This approach works briefly—but breaks at scale.

Credit Line on UPI is neither a traditional loan nor a card product. It is an account-based, UPI-native credit instrument that operates in real time across payments, repayments, and collections.

The need for a dedicated CLMS becomes clearer when viewed in the context of how banks implement Credit Line on UPI in practice, where lifecycle control, authorisation, and compliance cannot be handled as afterthoughts.

To run CLOU safely and compliantly, banks need a dedicated Credit Line Management System (CLMS)—not workarounds.

This article explains why a CLMS is essential for banks launching or scaling Credit Line on UPI.

In most issuer-led deployments, the CLMS operates as part of a broader Credit Line on UPI issuer architecture, sitting between the UPI switch and core banking systems.

A Credit Line Management System is the issuer’s system of record and control for all CLOU activities.

It manages the entire lifecycle of a credit line, including:

In short, the CLMS sits between the UPI switch and the bank’s core systems, enforcing credit logic at every step.

These limitations are especially visible in UPI-native credit environments, where real-time authorisation and limit updates are mandatory—unlike traditional loan models described in multi-rail credit portfolio design.Traditional Loan Management Systems (LMS) are designed for:

Credit Line on UPI, by contrast, requires:

Trying to retrofit CLOU into an LMS results in:

Card Management Systems (CMS) are optimised for:

CLOU operates differently:

As a result, card systems cannot provide:

A CLMS allows banks to configure multiple CLOU products, such as:

Each scheme can define:

This flexibility is critical as banks experiment with different CLOU use cases.

Unlike loans, CLOU limits change continuously.

A CLMS enables:

Without this, banks risk over-exposure and delayed risk response.

A CLMS enforces issuer-defined controls during every transaction:

Because these controls must operate before transaction approval, banks rely on issuer-grade risk controls in Credit Line on UPI rather than post-settlement monitoring.

CLOU repayments are fundamentally different from loan EMIs.

A CLMS supports:

Repayments immediately update available credit, improving customer experience and control.

A CLMS continuously computes:

It also integrates with issuer-defined:

This ensures CLOU portfolios remain regulator-ready at all times.

Credit Line on UPI is subject to:

A CLMS generates:

Without a CLMS, compliance becomes manual—and risky.

Banks attempting CLOU without a dedicated CLMS often face:

At scale, these issues directly impact portfolio health and regulator confidence.

CARD91 offers a configurable Credit Line Management System (Nimbus) designed specifically for banks launching Credit Line on UPI.

With CARD91’s CLMS, banks can:

This infrastructure-led approach allows banks to scale CLOU portfolios securely and compliantly.

Credit Line on UPI is redefining digital credit—but it demands a new operating model.

Banks that succeed with CLOU will:

A Credit Line Management System is not an enhancement—it is the foundation for sustainable CLOU programs.

In effect, a CLMS forms the operational backbone of an issuer-grade governance model for Credit Line on UPI, ensuring policy intent is enforced consistently across transactions, repayments, and reporting.

Q: What is a Credit Line Management System (CLMS)?

A: A CLMS is a platform that manages the full lifecycle of Credit Line on UPI—from scheme setup and transactions to repayments, delinquency, and reporting.

Q: Can banks launch CLOU without a CLMS?

A: Technically yes, but operationally risky. Without a CLMS, banks face reconciliation issues, delayed controls, and compliance gaps.

Q: Is a CLMS different from a Loan Management System?

A: Yes. A CLMS is built for real-time, revolving, UPI-native credit, unlike traditional LMS platforms.

Planning to launch or scale Credit Line on UPI? See how CARD91’s Credit Line Management System helps banks run CLOU with control, compliance, and confidence. Book a Demo

To know more about our offerings connect with our experts

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io