Regulated institutions are advised on designing and strengthening payment infrastructure technology that operates reliably under scale and regulatory scrutiny. Drawing on experience supporting issuer-grade systems in production, focus is placed on architecture, security, and operating model decisions that ensure infrastructure remains resilient, auditable, and scalable—before growth or compliance risk compounds.

CARD91 provides execution-informed advisory across the core layers of regulated payment infrastructure—covering architecture, deployment strategy, security, and operational governance.

We help institutions design core payment architecture that scales predictably without introducing fragility.

We advise on infrastructure models suited for regulated, high-availability payment workloads.

Security and compliance are designed into the infrastructure—not added after deployment.

We help define operating models that support reliability, accountability, and regulatory oversight at scale.

CARD91’s advisory teams bring 100+ years of collective experience across regulated payment programs. Supported by strong academic foundations, including IIT Kanpur, our advisors work one-on-one with leadership teams to validate critical decisions—ensuring programs are structured to launch cleanly, scale responsibly, and remain audit-ready.

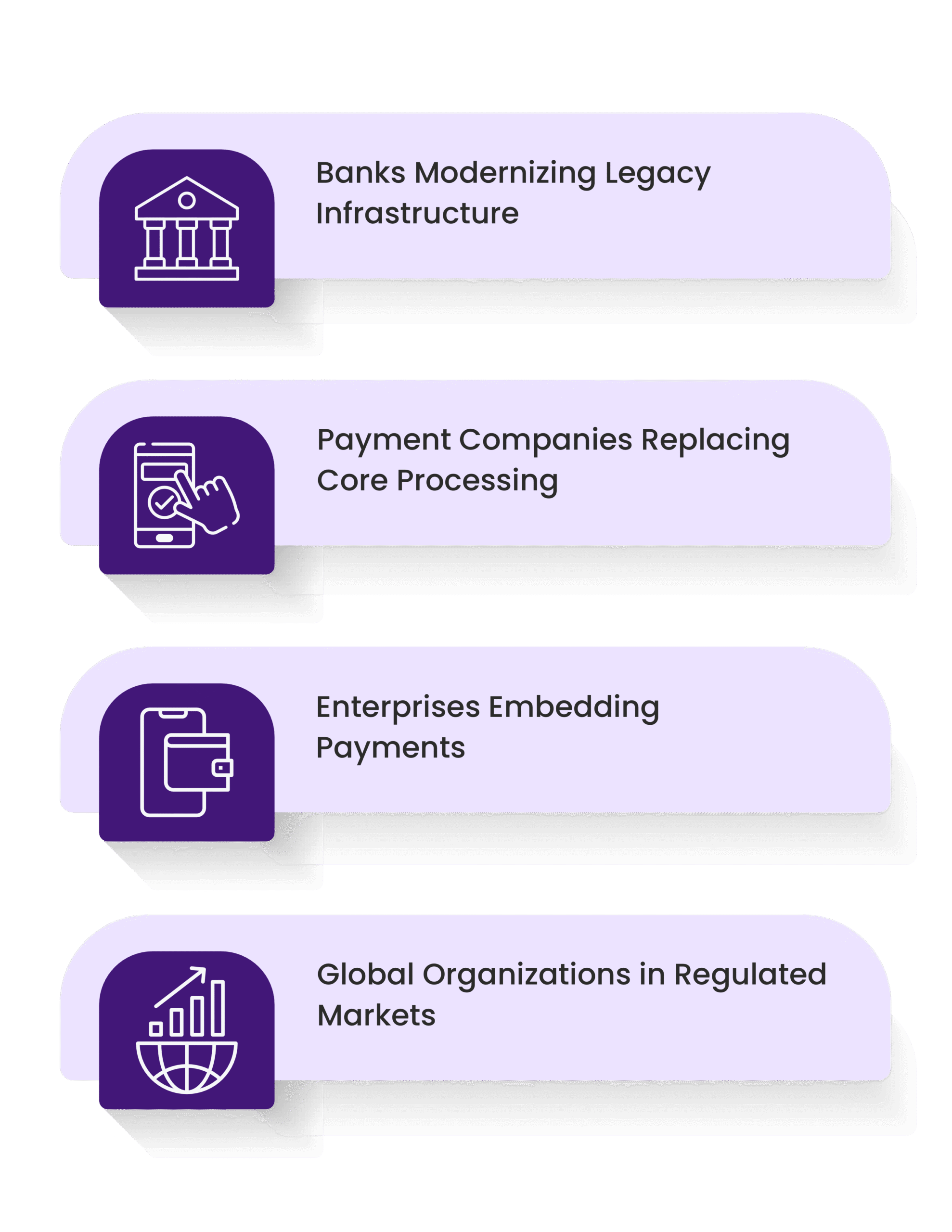

Modernising issuer and payment stacks with resilience, auditability, and long-term operating control.

Designing processing foundations that scale predictably—without fragility across authorization, clearing, and settlement.

Structuring embedded payment infrastructure with clear governance, security controls, and operational accountability.

Advising international teams on deploying compliant, localized infrastructure aligned with regulated market requirements.

Connect one-on-one with CARD91’s advisory team to validate critical payment decisions — before regulatory, financial, or execution risk compounds.

Submission of an inquiry through this website does not create a client, advisory, fiduciary, or contractual relationship. Any such relationship shall arise only upon execution of a formal written agreement. Confidential information shared during consultations will be handled in accordance with applicable confidentiality agreements.

Sales: sales@card91.io

HR: careers@card91.io

Media: comms@card91.io

Support: support@card91.io